Dana ekuitas swasta: Perbedaan antara revisi

koreksi typo |

Badak Jawa (bicara | kontrib) Tidak ada ringkasan suntingan Tag: Suntingan perangkat seluler Suntingan peramban seluler Suntingan seluler lanjutan |

||

| Baris 1: | Baris 1: | ||

{{Inuse}} |

|||

Mts Syekh Ibrahim Harun didirikan oleh Syekh Ibrahim Harun. Syekh Ibrahim Harun adalah ulama besar , lahir tahun 1884 , berasal dari Lubuak Jantan Lintau. Tahun 1927 Ia pindah ke payakumbuh dan menetap untuk dakwah di Tiakar. Di sinilah sejarah didirikannya madrasah. Syekh merupakan ulama tasawuf Naqsyabandiyah Khalidiyah. Beliau meninggal pada tahun 1967. Menurut salah satu referensi di channel youtube , beliau meninggalkan 5 istri dan 9 anak. |

|||

'''Dana ekuitas swasta''' (disingkat '''dana ES''') adalah [[skema investasi kolektif]] yang digunakan untuk melakukan investasi di berbagai sekuritas ekuitas (dan pada tingkat yang lebih rendah utang) menurut salah satu strategi investasi yang terkait dengan [[ekuitas swasta]]. Dana ekuitas swasta biasanya [[kemitraan terbatas]] dengan jangka waktu tetap 10 tahun (sering kali dengan perpanjangan tahunan). Pada awal, [[investor institusional]] membuat komitmen tanpa dana untuk persekutuan komanditer, yang kemudian ditarik selama jangka waktu dana tersebut. Dari sudut pandang investor, dana dapat bersifat tradisional (di mana semua investor berinvestasi dengan persyaratan yang sama) atau [[dana asimetris|asimetris]] (di mana investor yang berbeda memiliki persyaratan yang berbeda).<ref name="Metrick">Metrick, Andrew, and Ayako Yasuda. "The economics of private equity funds."Review of Financial Studies (2010): hhq020.</ref><ref>Prowse, Stephen D. "The economics of the private equity market." Economic Review-Federal Reserve Bank of Dallas (1998): 21-34.</ref> |

|||

Dana ekuitas swasta dikumpulkan dan dikelola oleh profesional investasi dari [[perusahaan ekuitas swasta]] tertentu ([[mitra umum]] dan penasihat investasi). Biasanya, satu perusahaan ekuitas swasta akan mengelola serangkaian dana ekuitas swasta yang berbeda dan akan berusaha mengumpulkan dana baru setiap 3 hingga 5 tahun karena dana sebelumnya diinvestasikan sepenuhnya.<ref name="Metrick" /> |

|||

==Legal structure and terms== |

|||

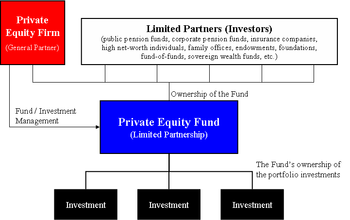

[[File:Private Equity Fund Diagram.png|350px|thumb|right|Diagram of the structure of a generic private-equity fund]] |

|||

Most private-equity funds are structured as [[limited partnerships]] and are governed by the terms set forth in the limited partnership agreement (LPA).<ref name="Kaplan">Kaplan, Steven N., and Antoinette Schoar. "Private equity performance: Returns, persistence, and capital flows." The Journal of Finance 60.4 (2005): 1791-1823.</ref> Such funds have a general partner, which raises capital from cash-rich institutional investors, such as pension plans, universities, insurance companies, foundations, endowments, and high-net-worth individuals, which invest as limited partners (LPs) in the fund. Among the terms set forth in the limited partnership agreement are the following:<ref name="Schell1999">{{cite book|author=James M. Schell|title=Private Equity Funds: Business Structure and Operations|url=https://books.google.com/books?id=9CXLWwVGDbQC&pg=SA3-PA7|date=1 January 1999|publisher=Law Journal Press|isbn=978-1-58852-088-3|pages=3–}}</ref><ref name="Müller2008">{{cite book|author=Kay Müller|title=Investing in Private Equity Partnerships: The Role of Monitoring and Reporting|url=https://books.google.com/books?id=JTFK7AWepyIC&pg=PA99|date=17 June 2008|publisher=Springer Science & Business Media|isbn=978-3-8349-9745-6|pages=99–}}</ref> |

|||

; Term of the partnership |

|||

Pranala luar |

|||

: The partnership is usually a fixed-life investment vehicle that is typically 10 years plus some number of extensions. |

|||

;[[Management fee]]s |

|||

: An annual payment made by the investors in the fund to the fund's manager to pay for the private-equity firm's investment operations (typically 1 to 2% of the committed capital of the fund).<ref name=calpersdictionary>[http://www.calpers.ca.gov/index.jsp?bc=/investments/assets/equities/aim/pe-glossary.xml Private equity industry dictionary] {{webarchive|url=https://web.archive.org/web/20080505124540/http://www.calpers.ca.gov/index.jsp?bc=%2Finvestments%2Fassets%2Fequities%2Faim%2Fpe-glossary.xml |date=2008-05-05 }}. [[CalPERS]] Alternative Investment Program</ref> |

|||

;[[Distribution waterfall]] |

|||

: The process by which the returned capital will be distributed to the investor, and allocated between limited and general partner. This waterfall includes the [[Minimum acceptable rate of return|preferred return]] : a minimum rate of return (e.g. 8%) which must be achieved before the general partner can receive any carried interest, and the [[carried interest]], the share of the profits paid the general partner above the preferred return (e.g. 20%).<ref name="calpersdictionary"/> |

|||

; Transfer of an interest in the fund |

|||

: Private equity funds are not intended to be transferred or traded; however, they can be transferred to another investor. Typically, such a transfer must receive the consent of and is at the discretion of the fund's manager.<ref name="CummingJohan2013">{{cite book|author1=Douglas J. Cumming|author2=Sofia A. Johan|title=Venture Capital and Private Equity Contracting: An International Perspective|url=https://books.google.com/books?id=EXWMHie6IxsC&pg=PA145|date=21 August 2013|publisher=Academic Press|isbn=978-0-12-409596-0|pages=145–}}</ref> |

|||

; Restrictions on the general partner |

|||

: The fund's manager has significant discretion to make investments and control the affairs of the fund. However, the LPA does have certain restrictions and controls and is often limited in the type, size, or geographic focus of investments permitted, and how long the manager is permitted to make new investments.<ref name="MetrickYasuda2010">{{cite journal|last1=Metrick|first1=Andrew|last2=Yasuda|first2=Ayako|title=The Economics of Private Equity Funds|journal=Review of Financial Studies|volume=23|issue=6|year=2010|pages=2303–2341|issn=0893-9454|doi=10.1093/rfs/hhq020|citeseerx=10.1.1.421.7270}}</ref> |

|||

The following is an illustration of the difference between a private-equity fund and a private-equity firm: |

|||

https://sumbar.kemenag.go.id/v2/post/23883/88-tahun-mtssponpes-syech-ibrahim-harun-bomban-tiakar-payakumbuh.html |

|||

{| class="wikitable" |

|||

|- |

|||

https://www.youtube.com/watch?v=aJ5VpzgzfFo |

|||

! Private equity firm |

|||

! Private equity fund |

|||

! Private equity portfolio investments (partial list) |

|||

|- |

|||

| rowspan="7" | [[Kohlberg Kravis Roberts]] & Co. (KKR) |

|||

| rowspan="7" | KKR 2006 Fund, L.P. <br>($17.6 billion of commitments) |

|||

| [[Alliance Boots]] |

|||

|- |

|||

| [[Dollar General]] |

|||

|- |

|||

| [[Energy Future Holdings Corporation]] |

|||

|- |

|||

| [[First Data Corp]] |

|||

|- |

|||

| [[Hospital Corporation of America]] |

|||

|- |

|||

| [[Nielsen Company]] |

|||

|- |

|||

| [[NXP Semiconductors]] |

|||

|} |

|||

==Referensi== |

|||

{{reflist|2}} |

|||

Revisi per 1 Juni 2023 07.05

Dana ekuitas swasta (disingkat dana ES) adalah skema investasi kolektif yang digunakan untuk melakukan investasi di berbagai sekuritas ekuitas (dan pada tingkat yang lebih rendah utang) menurut salah satu strategi investasi yang terkait dengan ekuitas swasta. Dana ekuitas swasta biasanya kemitraan terbatas dengan jangka waktu tetap 10 tahun (sering kali dengan perpanjangan tahunan). Pada awal, investor institusional membuat komitmen tanpa dana untuk persekutuan komanditer, yang kemudian ditarik selama jangka waktu dana tersebut. Dari sudut pandang investor, dana dapat bersifat tradisional (di mana semua investor berinvestasi dengan persyaratan yang sama) atau asimetris (di mana investor yang berbeda memiliki persyaratan yang berbeda).[1][2]

Dana ekuitas swasta dikumpulkan dan dikelola oleh profesional investasi dari perusahaan ekuitas swasta tertentu (mitra umum dan penasihat investasi). Biasanya, satu perusahaan ekuitas swasta akan mengelola serangkaian dana ekuitas swasta yang berbeda dan akan berusaha mengumpulkan dana baru setiap 3 hingga 5 tahun karena dana sebelumnya diinvestasikan sepenuhnya.[1]

Legal structure and terms

Most private-equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement (LPA).[3] Such funds have a general partner, which raises capital from cash-rich institutional investors, such as pension plans, universities, insurance companies, foundations, endowments, and high-net-worth individuals, which invest as limited partners (LPs) in the fund. Among the terms set forth in the limited partnership agreement are the following:[4][5]

- Term of the partnership

- The partnership is usually a fixed-life investment vehicle that is typically 10 years plus some number of extensions.

- Management fees

- An annual payment made by the investors in the fund to the fund's manager to pay for the private-equity firm's investment operations (typically 1 to 2% of the committed capital of the fund).[6]

- Distribution waterfall

- The process by which the returned capital will be distributed to the investor, and allocated between limited and general partner. This waterfall includes the preferred return : a minimum rate of return (e.g. 8%) which must be achieved before the general partner can receive any carried interest, and the carried interest, the share of the profits paid the general partner above the preferred return (e.g. 20%).[6]

- Transfer of an interest in the fund

- Private equity funds are not intended to be transferred or traded; however, they can be transferred to another investor. Typically, such a transfer must receive the consent of and is at the discretion of the fund's manager.[7]

- Restrictions on the general partner

- The fund's manager has significant discretion to make investments and control the affairs of the fund. However, the LPA does have certain restrictions and controls and is often limited in the type, size, or geographic focus of investments permitted, and how long the manager is permitted to make new investments.[8]

The following is an illustration of the difference between a private-equity fund and a private-equity firm:

| Private equity firm | Private equity fund | Private equity portfolio investments (partial list) |

|---|---|---|

| Kohlberg Kravis Roberts & Co. (KKR) | KKR 2006 Fund, L.P. ($17.6 billion of commitments) |

Alliance Boots |

| Dollar General | ||

| Energy Future Holdings Corporation | ||

| First Data Corp | ||

| Hospital Corporation of America | ||

| Nielsen Company | ||

| NXP Semiconductors |

Referensi

- ^ a b Metrick, Andrew, and Ayako Yasuda. "The economics of private equity funds."Review of Financial Studies (2010): hhq020.

- ^ Prowse, Stephen D. "The economics of the private equity market." Economic Review-Federal Reserve Bank of Dallas (1998): 21-34.

- ^ Kaplan, Steven N., and Antoinette Schoar. "Private equity performance: Returns, persistence, and capital flows." The Journal of Finance 60.4 (2005): 1791-1823.

- ^ James M. Schell (1 January 1999). Private Equity Funds: Business Structure and Operations. Law Journal Press. hlm. 3–. ISBN 978-1-58852-088-3.

- ^ Kay Müller (17 June 2008). Investing in Private Equity Partnerships: The Role of Monitoring and Reporting. Springer Science & Business Media. hlm. 99–. ISBN 978-3-8349-9745-6.

- ^ a b Private equity industry dictionary Diarsipkan 2008-05-05 di Wayback Machine.. CalPERS Alternative Investment Program

- ^ Douglas J. Cumming; Sofia A. Johan (21 August 2013). Venture Capital and Private Equity Contracting: An International Perspective. Academic Press. hlm. 145–. ISBN 978-0-12-409596-0.

- ^ Metrick, Andrew; Yasuda, Ayako (2010). "The Economics of Private Equity Funds". Review of Financial Studies. 23 (6): 2303–2341. CiteSeerX 10.1.1.421.7270

. doi:10.1093/rfs/hhq020. ISSN 0893-9454.

. doi:10.1093/rfs/hhq020. ISSN 0893-9454.